GXS Bank

Terms and conditions governing Pocket Locket Campaign (“Promotion”)

By participating in the Promotion with GXS Bank Pte. Ltd. (“GXS” or “Bank”), you agree to the following terms and conditions (“Terms”):

1. Eligibility:

You are eligible to participate in the Promotion if you are a customer of GXS and have received a message in the inbox of your GXS Bank app, and/or via email sent to your email address on record with the Bank, notifying you of your eligibility to participate in the Promotion to receive a reward (“Notification”).

2. Promotion Period:

The Promotion is available during the dates stated in the Notification or such date(s) as determined and notified by the Bank in its sole discretion (“Promotion Period”).

3. Programme:

- By fulfilling the requirements of the Promotion, you shall be entitled to receive Bonus Interest (as defined below) for successfully fulfilling the requirements for deposits placed in Pocket Lockets (as defined below) (“Successful Customer”):

- To be a Successful Customer, you must:

i. prior to the start of the Promotion Period:

1. deposit fresh funds of between S$1,000 and S$30,000 into your GXS Savings Account by the dates stated in the Notification or such date(s) as determined and notified by the Bank in its sole discretion, subject to the maximum balance amount of your GXS Savings Account;

2. create one or more Pocket Lockets by creating new Saving Pocket(s), and name them ‘Pocket Locket’. You may create up to eight (8) Pocket Lockets;

3. fund at least S$1,000 across one or more Pocket Lockets (“Minimum Principal Amount”), up to a maximum of S$30,000 across one or more Pocket Lockets (“Maximum Principal Amount”); and

ii. throughout the Promotion Period, maintain between the Minimum Principal Amount and Maximum Principal Amount across all Pocket Lockets within your GXS Savings Account (“Qualifying Deposit Amount”).

- Bonus Interest shall be payable on the Qualifying Deposit Amount only. No Bonus Interest shall be payable on the interest paid to you for deposits in the Pocket Lockets. For the avoidance of doubt, you will continue to earn the interest at the prevailing rate for Saving Pockets for deposits in the Pocket Lockets.

- The closure of a Pocket Locket, or partial or premature withdrawal from all Pocket Lockets such that the Minimum Principal Amount is not met, for any reason shall be deemed to be early termination of a Pocket Locket, and will not fulfil the requirements of this Promotion.

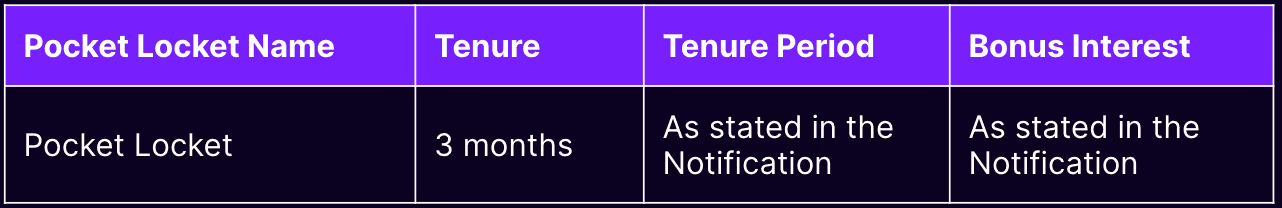

- “Bonus Interest” means bonus interest paid on the Qualifying Deposit Amount across one or more Pocket Lockets only. Bonus Interest shall not be payable or paid on the interest earned on the principal amount of funds deposited in each Pocket Locket. If you do not meet the eligibility criteria for the Bonus Interest during the Tenure Period, you will not receive the Bonus Interest.

- “Fresh funds” means funds not transferred or withdrawn from any existing GXS Savings Account (i.e. not transferred from a Main Account or any Saving Pocket), and re-deposited into your GXS Savings Account.

- “GXS Savings Account” means the GXS Savings Account, for which more information and terms and conditions can be found at https://www.gxs.com.sg/tnc.

- “Pocket Locket” means a new Saving Pocket of your GXS Savings Account, created on or before 11 March 2024, and named “Pocket Locket” for a tenure of three (3) months during the period stated in the Notification.

- “Tenure Period” means the dates stated in the Notification, during which the Minimum Principal Amount must be maintained in each Pocket Locket.

- Bonus Interest is issued on a first-come-first served basis and is while stocks last.

- You are entitled to receive a maximum of one (1) Bonus Interest per Pocket Locket throughout the Promotion Period.

- The Bonus Interest shall be credited to the Main Account of your GXS Savings Account [within 14 days of the following month from the month in which] after the Promotion Period.

- If your GXS Savings Account is closed prior to the crediting of the Bonus Interest for any reason, or if the Minimum Principal Amount is not met, the Bonus Interest that has yet to be credited will be forfeited.

- Bonus Interest is not exchangeable for cash, credit or any other items, and cannot be transferred or assigned.

- The Bank reserves the right to replace, exchange, vary or substitute the Bonus Interest with an item(s) of equivalent value at its sole discretion without prior notice or reason and without liability to any persons.

- If the Bank at any time determines at its sole and absolute discretion that any of the requirements of the Promotion were not met or complied with, the Bank reserves the right to recover any or all Bonus Interest (or its equivalent value) by deduction from your GXS Savings Account or any account you maintain with us.

- This Programme is not valid with other programmes or promotions unless otherwise stated.

- The Bank may add to, amend, modify or vary any or all of these Terms at any time without notice or liability to any person.

- The Bank’s records and decisions on all matters relating to the Promotion (including but not limited to the eligibility of any person to participate in the Promotion and the awarding of any cashback, voucher or item) shall be final, conclusive and binding on all customers. We are not obliged to entertain any correspondence.

- In the event of any inconsistency between these Terms and any brochure, marketing or informational material relating to the Programme, these Terms shall prevail.

- The Bank, employees and/or independent contractors shall not be liable for any loss, liability, expense, damage and/or injury whatsoever or howsoever incurred or sustained by any person by reason of, arising from or in connection with the Promotion including the redemption or use of any good, service, product or facility of any merchant (if applicable) or for any other reason.

- The Bank is not responsible for any failure or delay in the transmission of any transaction by any party, including acquiring merchants, merchant establishments or any telecommunication provider.

- These Terms shall be governed by and interpreted in accordance with Singapore law, and you agree to submit to the exclusive jurisdiction of the Singapore courts.

- A third party who is not a party to these Terms shall have no rights under the Contracts (Rights of Third Parties) Act 2001 of Singapore to enforce or enjoy the benefit of any provision of these Terms.

- These Terms shall apply in conjunction with the Deposit Account Terms, which shall apply.

- All information is accurate at the time of publication.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

GXS Bank Pte. Ltd. (UEN: 202005626H)